case Study

FIGURE TECHNOLOGIES

“SAVING AMERICA BILLIONS”

High-profile fintech Figure needed to build lending volume in advance of a new funding round. As Head of Corporate Communications, Otto Pohl conceived and executed a data-driven campaign that helped increase loan volume 23%, to over $80m/month. Less than three months later, the company closed a $100m round at over 3x the previous valuation.

BACKGROUND

Figure is a rapidly-growing fintech founded by Mike Cagney, co-founder and former CEO of SoFi. In the summer of 2019, Mike was laying the groundwork for raising a round later that year that would catapult the company into unicorn status, with a valuation of $1.2B—over 3x the $380m valuation from February.

THE CHALLENGE

A key piece of justifying the valuation was showing that the lending business was growing quickly. At that time, the company’s only active lending product was a Home Equity Line of Credit (HELOC), which is where a homeowner borrows against their home—essentially, a second mortgage. Figure needed more HELOC volume. The challenge was to come up with an effective, low-cost solution that the marketing department could use to drive awareness, market share, and loan volume.

The campaign

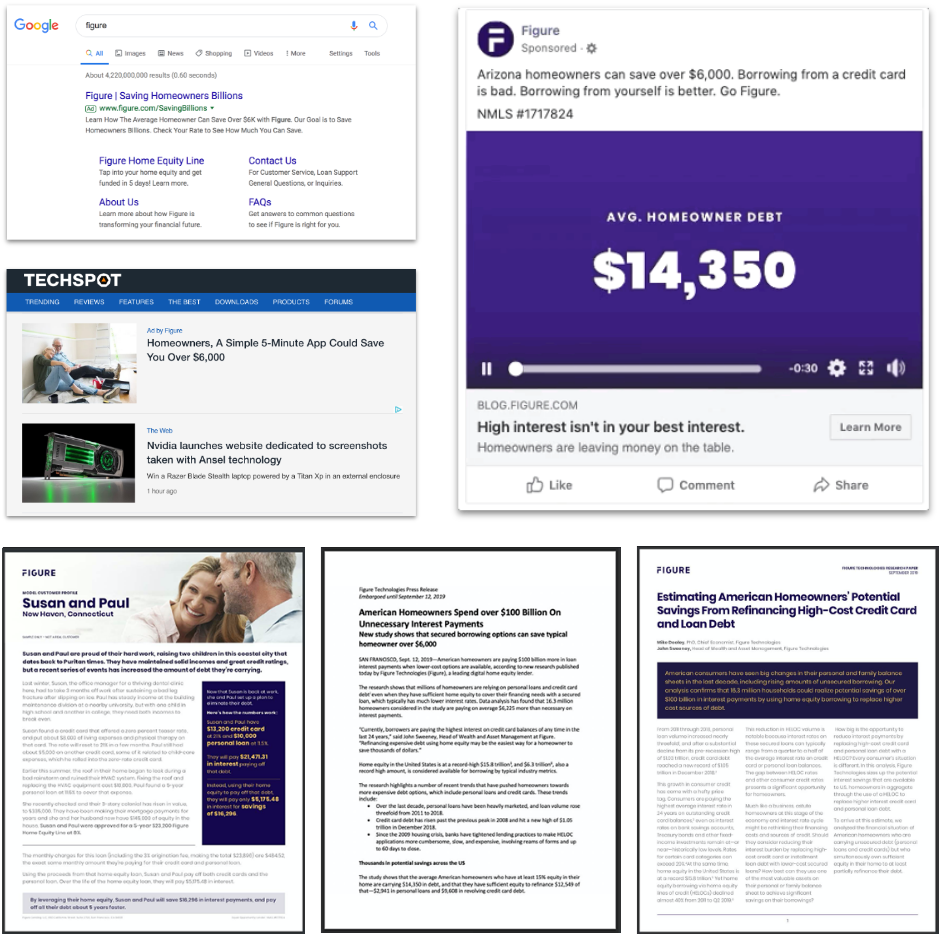

I wrote three foundational pieces for the campaign (search, display, social, press release, white paper, case study):

The Result

I researched government statistics that showed that unsecured consumer borrowing, like credit card debt and personal loans, was at record highs, while secured borrowing, like HELOCs, were declining year-over-year. At the same time, interest rates for unsecured borrowing were at record highs and secured borrowing interest rates were at record lows. To top it off, consumers owned a record amount of home equity. Why were consumers avoiding low-cost borrowing options while gorging on expensive debt? At first, I thought that maybe it was two separate groups—those without homes were borrowing while homeowners didn’t need to. Working with Figure’s data and analytics team, I led a project to analyze consumer credit records of every homeowner in America. The result was remarkable: It turned out that there were over 16 million US homeowners who both had substantial home equity and were carrying high-cost debt. We calculated that they could save over $100 billion in interest payments if they refinanced. We had our story.

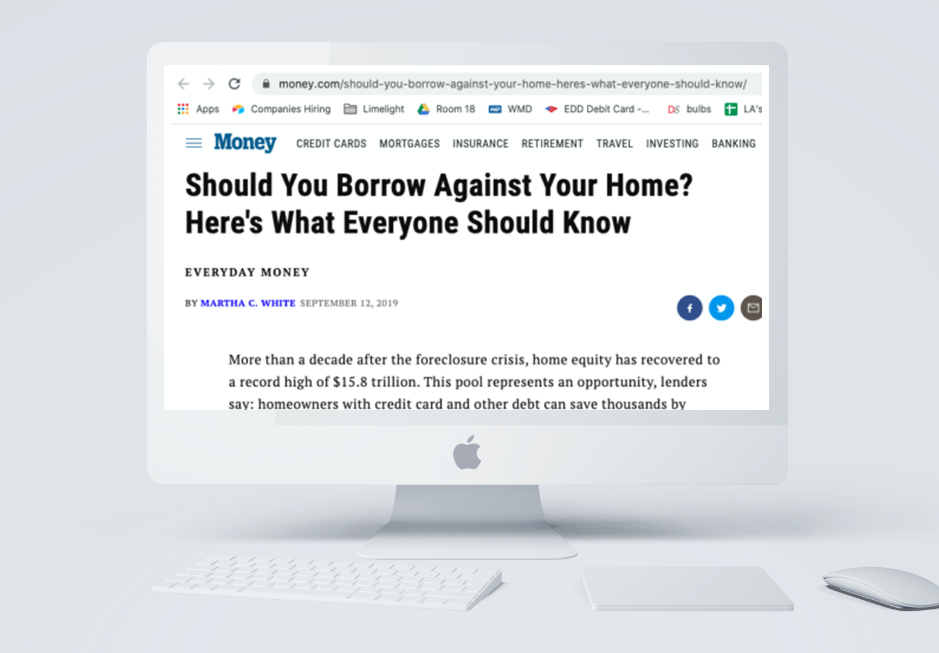

Magazine Articles including Money

The campaign resonated among the key target group of financial journalists.Earned media placements included: Money.com

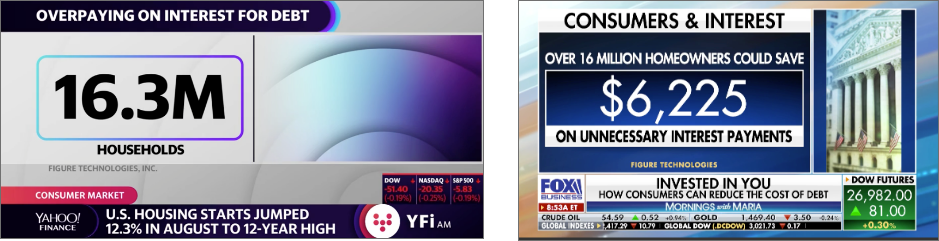

Television Included:

Fox and Yahoo Business

the bottom line

The campaign launched in September. Figure HELOC volume increased 23%to over $80 million per month. Mike closed a $103m series C in early December at a $1.2B post-money valuation.